Designed by Elizabeth Gething

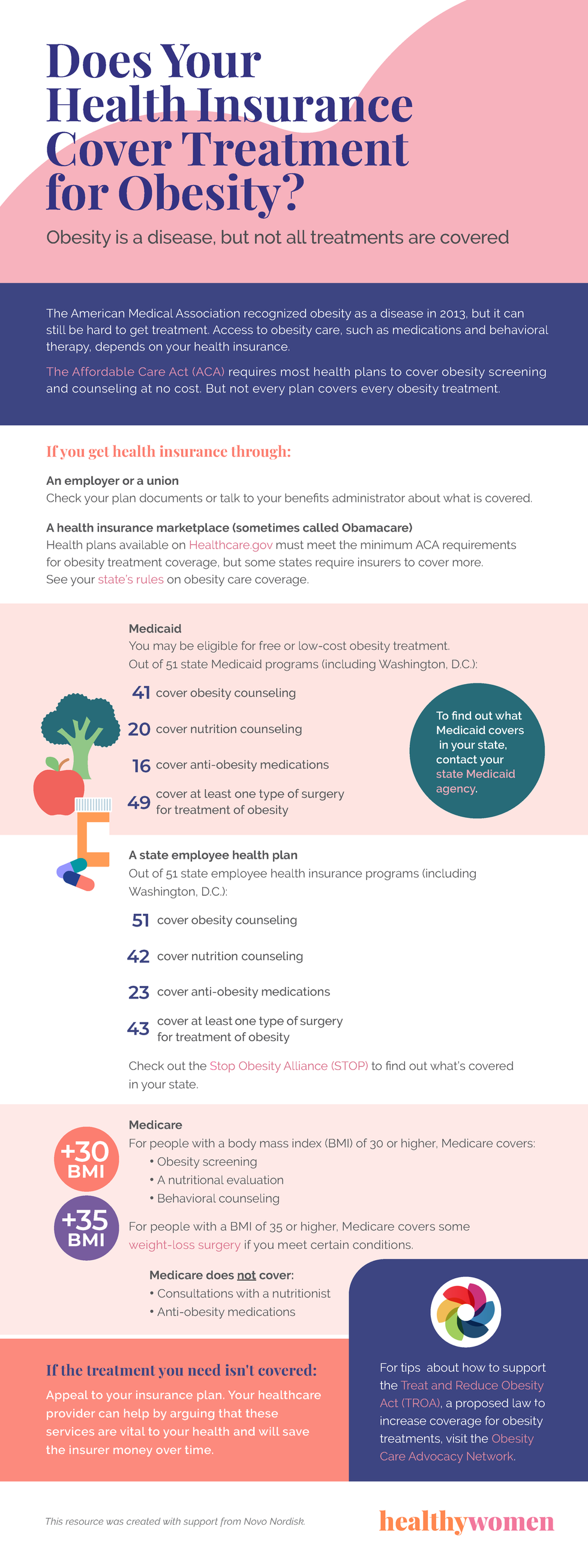

The American Medical Association recognized obesity as a disease in 2013, but it can still be hard to get treatment. Access to obesity care, such as medications and behavioral therapy, depends on your health insurance.

The Affordable Care Act (ACA) requires most health plans to cover obesity screening and counseling at no cost. But not every plan covers every obesity treatment.

If you get health insurance through:

An employer or a union

Check your plan documents or talk to your benefits administrator about what is covered.

A health insurance marketplace (sometimes called Obamacare)

Health plans available on Healthcare.gov must meet the minimum ACA requirements for obesity treatment coverage, but some states require insurers to cover more. See your state’s rules on obesity care coverage.

Medicaid

You may be eligible for free or low-cost obesity treatment. Out of 51 state Medicaid programs (including Washington, D.C.):

- 41 cover obesity counseling

- 20 cover nutrition counseling

- 16 cover anti-obesity medications

- 49 cover at least one type of surgery for the treatment of obesity

To find out what Medicaid covers in your state, contact your state Medicaid agency.

A state employee health plan

Out of 51 state employee health insurance programs (including Washington, D.C.):

- 51 cover obesity counseling

- 42 cover nutritional counseling

- 23 cover anti-obesity medications

- 43 cover at least one type of surgery for the treatment of obesity

Check out the Stop Obesity Alliance (STOP) to find out what’s covered in your state.

Medicare

For people with a body mass index (BMI) of 30 or higher, Medicare covers:

- Obesity screening

- A nutritional evaluation

- Behavioral counseling

For people with a BMI of 35 or higher, Medicare covers some weight-loss surgery if you meet certain conditions.

Medicare does not cover:

- Consultations with a nutritionist

- Anti-obesity medications

- Cosmetic surgery

If the treatment you need isn’t covered:

Appeal to your insurance plan. Your healthcare provider can help by arguing that these services are vital to your health and will save the insurer money over time.

For tips about how to support the Treat and Reduce Obesity Act (TROA), a proposed law to increase coverage for obesity treatments, visit the Obesity Care Advocacy Network.

This resource was created with support from Novo Nordisk.

- The Importance of Obesity Treatment - HealthyWomen ›

- Trying an Anti-Obesity Medication Changed My Life - HealthyWomen ›

- Obesity Is a Complex Disease With a Variety of Treatments - HealthyWomen ›

- Cómo pedir a tu empleador cobertura de atención para la obesidad - HealthyWomen ›

- How to Ask Your Employer for Obesity Care Insurance Coverage - HealthyWomen ›

- Medicare and Obesity - HealthyWomen ›

- Anti-Obesity Medication Facts - HealthyWomen ›

- Anti-Obesity Medication Stopped My Obsessive Thoughts - HealthyWomen ›

- Why Are Obesity Treatments Hard to Get? - HealthyWomen ›