When Ronda Morra, 49, lost her job just before COVID-19, the cost of treating her severe endometriosis came into focus.

Though Morra found another job during the pandemic, her health insurance benefits got worse. She had to satisfy a $1,500 deductible for medications before insurance would pay for them. The birth control pills prescribed to treat her condition — which would most likely have been free under Affordable Care Act rules if she’d needed them for contraception — cost her $90 per month.

“I could have paid less in copayments to have a hysterectomy,” Morra said. “It’s ridiculous.”

Morra thinks there’s something wrong — and uniquely American — about her situation.

“If I had been in Canada, this wouldn't have been an issue,” she said. “I wouldn't have been weighing costs as opposed to what's best for my health.”

Though Morra feels lucky to have been able to pay for her medication, thanks to unemployment assistance and her husband’s income, Americans increasingly have to consider the cost of care. For many, costs are an outright obstacle to getting the care they need.

According to a new HealthyWomen survey conducted with 1,011 women ages 35 to 64, 81% reported that they consider costs when making treatment decisions, and 61% said they’ve considered not getting care because they thought it would be too expensive.

Only 18% of women surveyed said they strictly follow treatment plans, including prescriptions, regardless of cost. For everyone else, cost or coverage affected their healthcare decisions.

For example, because of overall cost, 29% of women surveyed had decided not to take a particular medication or fill a prescription, 23% changed medications and 15% said they decided against other types of treatment, such as surgery.

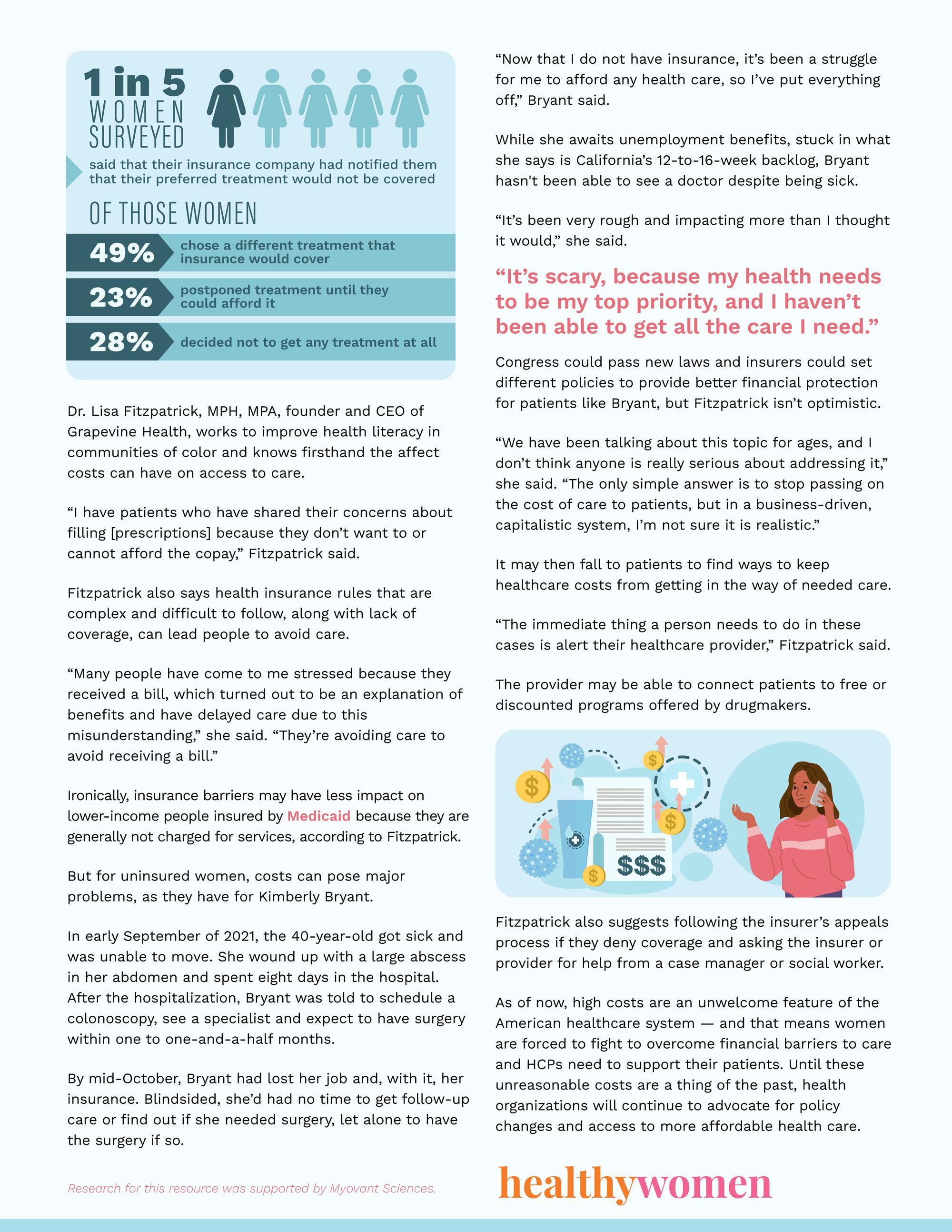

Beyond total cost, health insurance coverage limitations also forced many women to adjust or forgo treatment, according to the survey.

Nearly one in five (18%) women said that their insurance company had notified them that their preferred treatment would not be covered. Of those, 49% chose a different treatment — one that insurance would cover — and 23% postponed treatment until they could afford to pay for it themselves. Perhaps most concerning, 28% decided not to get any treatment at all.

Dr. Lisa Fitzpatrick, MPH, MPA, founder and CEO of Grapevine Health, works to improve health literacy in communities of color and knows firsthand the affect costs can have on access to care.

“I have patients who have shared their concerns about filling [prescriptions] because they don’t want to or cannot afford the copay,” Fitzpatrick said.

Fitzpatrick also says health insurance rules that are complex and difficult to follow, along with lack of coverage, can lead people to avoid care.

“Many people have come to me stressed because they received a bill, which turned out to be an explanation of benefits and have delayed care due to this misunderstanding,” she said. “They’re avoiding care to avoid receiving a bill.”

Ironically, insurance barriers may have less impact on lower-income people insured by Medicaid because they are generally not charged for services, according to Fitzpatrick.

But for uninsured women, costs can pose major problems, as they have for Kimberly Bryant.

In early September of 2021, the 40-year-old got sick and was unable to move. She wound up with a large abscess in her abdomen and spent eight days in the hospital. After the hospitalization, Bryant was told to schedule a colonoscopy, see a specialist and expect to have surgery within one to one-and-a-half months.

By mid-October, Bryant had lost her job and, with it, her insurance. Blindsided, she’d had no time to get follow-up care or find out if she needed surgery, let alone to have the surgery if so.

“Now that I do not have insurance, it’s been a struggle for me to afford any health care, so I’ve put everything off,” Bryant said.

While she awaits unemployment benefits, stuck in what she says is California’s 12-to-16-week backlog, Bryant hasn't been able to see a doctor despite being sick.

“It’s been very rough and impacting more than I thought it would,” she said. “It’s scary, because my health needs to be my top priority and I haven’t been able to get all the care I need.”

Congress could pass new laws and insurers could set different policies to provide better financial protection for patients like Bryant, but Fitzpatrick isn’t optimistic.

“We have been talking about this topic for ages, and I don’t think anyone is really serious about addressing it,” she said. “The only simple answer is to stop passing on the cost of care to patients, but in a business-driven, capitalistic system, I’m not sure it is realistic.”

It may then fall to patients to find ways to keep healthcare costs from getting in the way of needed care.

“The immediate thing a person needs to do in these cases is alert their healthcare provider,” Fitzpatrick said.

The provider may be able to connect patients to free or discounted programs offered by drug makers.

Fitzpatrick also suggests following the insurer’s appeals process if they deny coverage and asking the insurer or provider for help from a case manager or social worker.

As of now, high costs are an unwelcome feature of the American healthcare system — and that means women are forced to fight to overcome financial barriers to care and HCPs need to support their patients. Until these unreasonable costs are a thing of the past, health organizations will continue to advocate for policy changes and access to more affordable health care.

Research for this resource was supported by Myovant Sciences.

- Hospital Prices Must Now Be Transparent. For Many Consumers ... ›

- Black and Hispanic Americans Suffer Most in Biggest US Decline in ... ›

- HIV Preventive Care Is Supposed to Be Free in the US. So, Why Are ... ›

- What the American Rescue Plan Says About President Biden’s Health Care Priorities – and What They Mean for You - HealthyWomen ›

- Staying Active Throughout Adulthood Is Linked to Lower Healthcare Costs in Later Life – New Research - HealthyWomen ›

- Healthcare Costs & Price of Low Financial Health Literacy - HealthyWomen ›